working capital funding gap formula

Working Capital Days Receivable Days Inventory Days Payable Days. Ad Turn your outstanding invoices and accounts receivable into working capital.

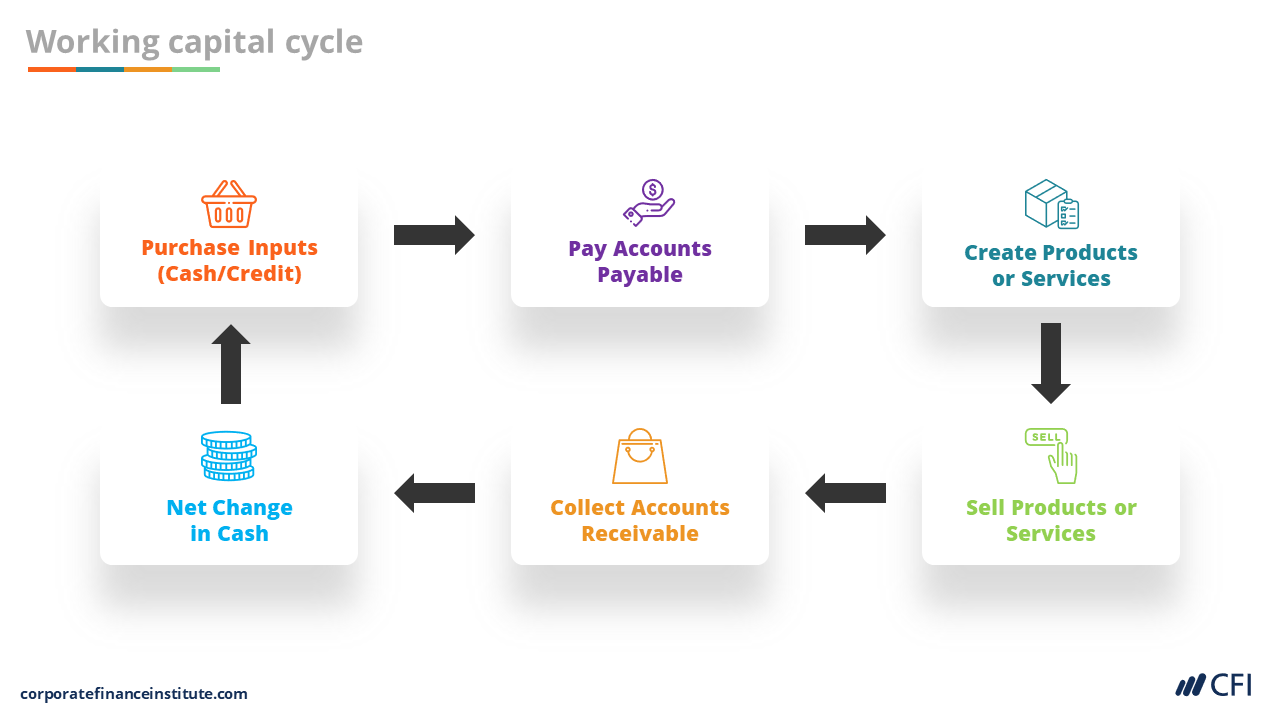

Working Capital Cycle Understanding The Working Capital Cycle

After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the.

. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach. Ad Delivering Better Decisions Accelerated Results - From Idea to Implementation. Funding in as little as 24 hours.

Current assets Assets converted to cash value within a normal operating cycle Current liabilities Debts or. Ad Up to 500000 in 24 Hours For All Credit Levels Based On Cash Flow. Analysts may use either average or end-of-period assets.

Average Total Assets Total assets at the end of the period Total assets at the beginning of the period 2. Compare Up To 5 Loans Without a Hard Credit Pull. Ad Click Now Find 2022s Top Working Capital Loan Companies.

Learn how to get immediate business capital by turning your invoices into cash right away. To calculate working capital subtract a companys current liabilities from its current assets. Ad Get Your Small Business Funded Fast.

This ratio measures how efficiently a company is able to convert its working capital into revenue. A positive amount of working capital means a company can meet its short. Ad Apply now to see options from 75 lenders.

For example say a company has 100000 of current assets and. Easy Online Form Up to 5M as Fast as 24hrs Low Rates Connect With Top Lenders. The cash gap is the number of days between a businesss payment of cash for goods and services bought and the receipt of cash from its customers for goods or services sold.

Working capital increases because accounts receivable goes up by 50000 and inventory decreases by 41000. Working Capital Current Assets Current Liabilities where. 10000 Monthly Deposits Into Business Bank Account.

Working Capital Current Assets - Current Liabilities. Check out our trade and receivables financing options. To calculate the working capital needs one needs to use the following formula.

Theres no change in current liabilities. Go to the LendingTree Official Site Get Offers. Best Loan Options From More Lenders.

Net working Capital Current Assets Current Liabilities Here the working capital calculation considers all. Loans Up To 500k. Contact Us to Learn More About How Our Capital Allocation Services Can Help.

Ad Flexible Versatile Asset-Based Loans From Bank of America. Ad Flexible Versatile Asset-Based Loans From Bank of America. Also keep in mind that.

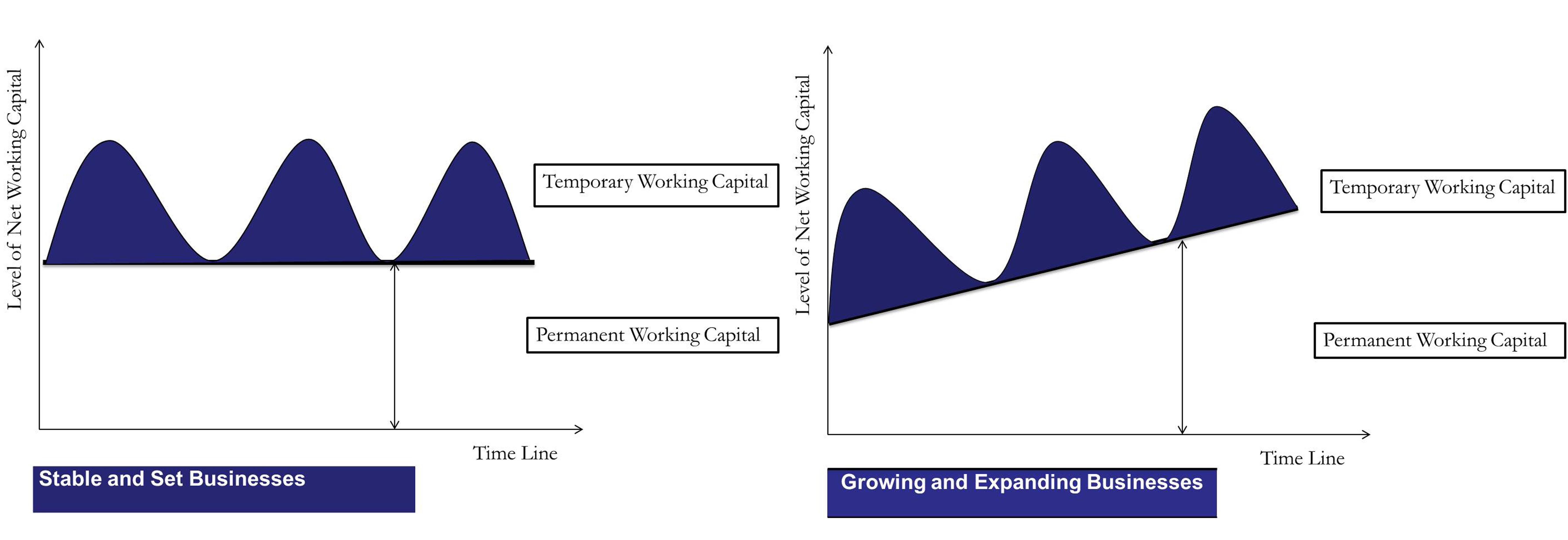

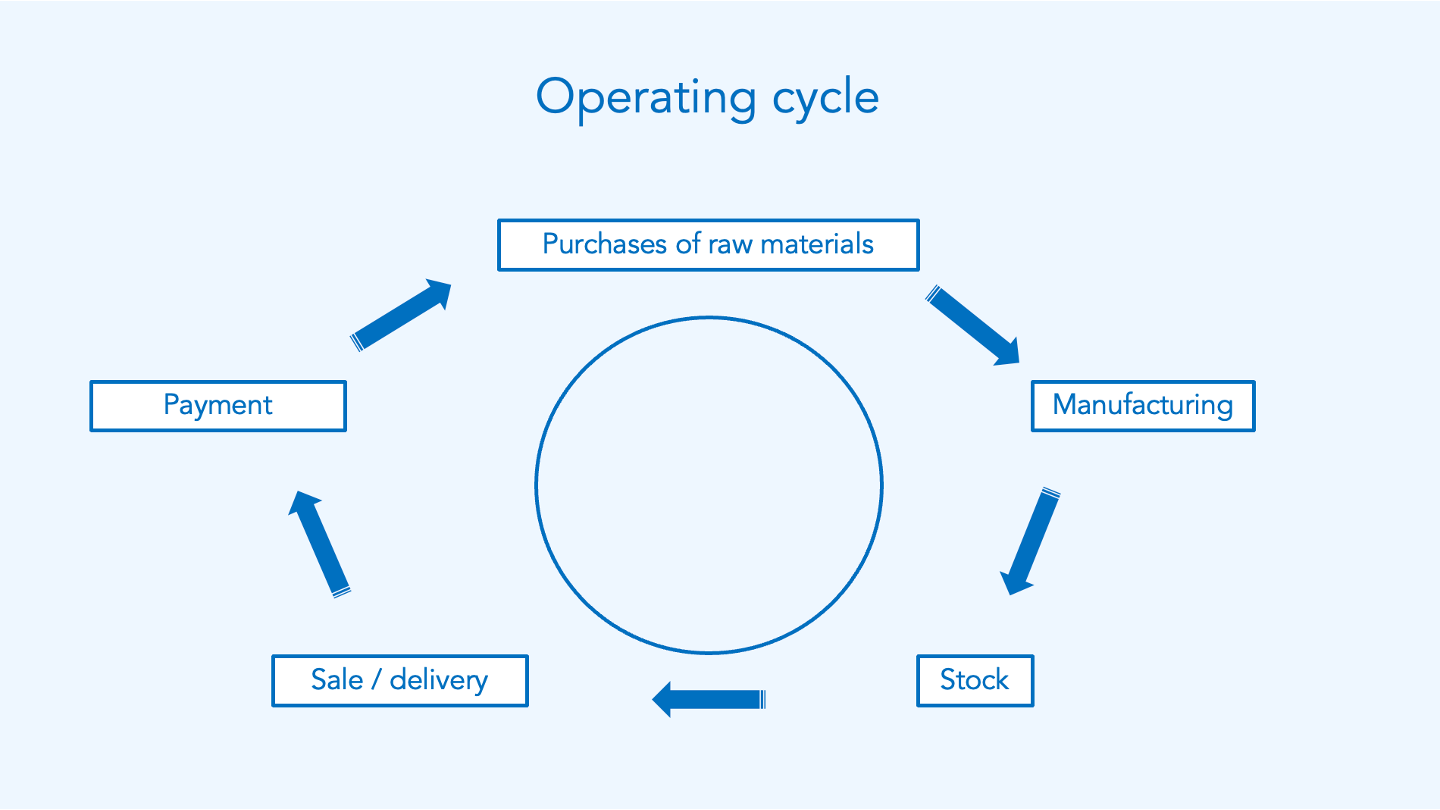

Working capital is often stated as a dollar figure. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas.

Modelling Working Capital Adjustments In Excel Fm

Working Capital Requirement Wcr Agicap

Working Capital Requirement Wcr Agicap

Methods For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Working Capital Cycle What Is It With Calculation

Working Capital What Is Working Capital Youtube

Cash Flow Cycles And Analysis I Finance Course I Cfi

What Is Net Working Capital How To Calculate Nwc Formula

Cash Conversion Cycle Ccc Formula And Excel Calculator

Working Capital Requirement Wcr Agicap

Modelling Working Capital Adjustments In Excel Fm

Working Capital Financial Edge Training

Working Capital Management Estimation And Calculation

What Is Working Capital Gap Banking School

Methods For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Working Capital Requirement Wcr Agicap

Working Capital Cycle Efinancemanagement