nassau county property tax rate 2021

Nassau County Stats for Property Taxes. March 01 2021 0342 PM.

Average reductions for 2020-21 were 55.

. In Suffolk residents file with the town in which they reside and the deadline is May 18 2021. Fernandina Beach FL 32034. August 10 th Is an Important Tax Deadline.

While the temptation during these warm wonderful summer months is to. Some Nassau County property owners are a bit surprised at their tax bills this year following a countywide reassessment. Michael Hickox Nassau County Property Appraiser.

Authorizes the county of Nassau assessor to accept an application for a real property tax exemption from the Nassau Cemetery Association with respect to the 2020-2021 assessment roll for part of the 2020-2021 school taxes and part of the 2021 general taxes and the 2021-2022 assessment roll for all of the 2021-2022 school taxes and all of the 2022 general. This is the total of state and county sales tax rates. Cobra charges only 40 of the tax reduction secured through the assessment reduction.

The deadline to file is March 1 2022. You can pay in person at any of our locations. It states the fair market assessed and taxable values.

The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown above due to either of the following reasons. Nassau County Tax Collector. NASSAU COUNTY PROPERTY APPRAISER A.

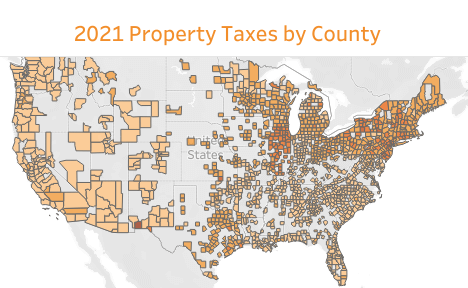

Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax. We provided the 2021 estimated values to the taxing authorities on May 28th so they can begin their budget process using these preliminary figures. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

Obviously it pays to grieve and we sincerely hope that youll let Maidenbaum handle your 202324 Nassau County property tax grievance. 2 days agoNew data from the Nassau Assessment Department shows the 22000 homeowners school tax obligation dropped by a total of 498 million in the 2021-22 tax year while their county and town property. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made.

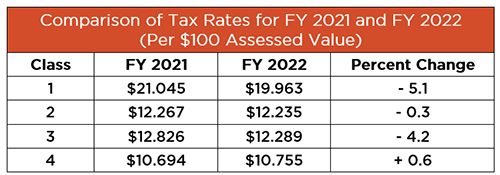

The New York state sales tax rate is currently 4. Seven weeks ahead of election day Nassau County Executive Laura Curran is offering voters a deal. For 2021-22 average reductions were 64.

Typically this means that people will pay an average of about 11232 per year just on their property taxes. The plan which will result in payments of up to 375 for qualifying residents has been approved by the Nassau County Legislature. Exemptions and proposed taxes are for 2021.

The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents. Michael Hickox CFA 96135 Nassau Place Suite 4 Yulee FL 32097 Phone. According to the county taxes will rise for 52 of homeowners and decline for 48.

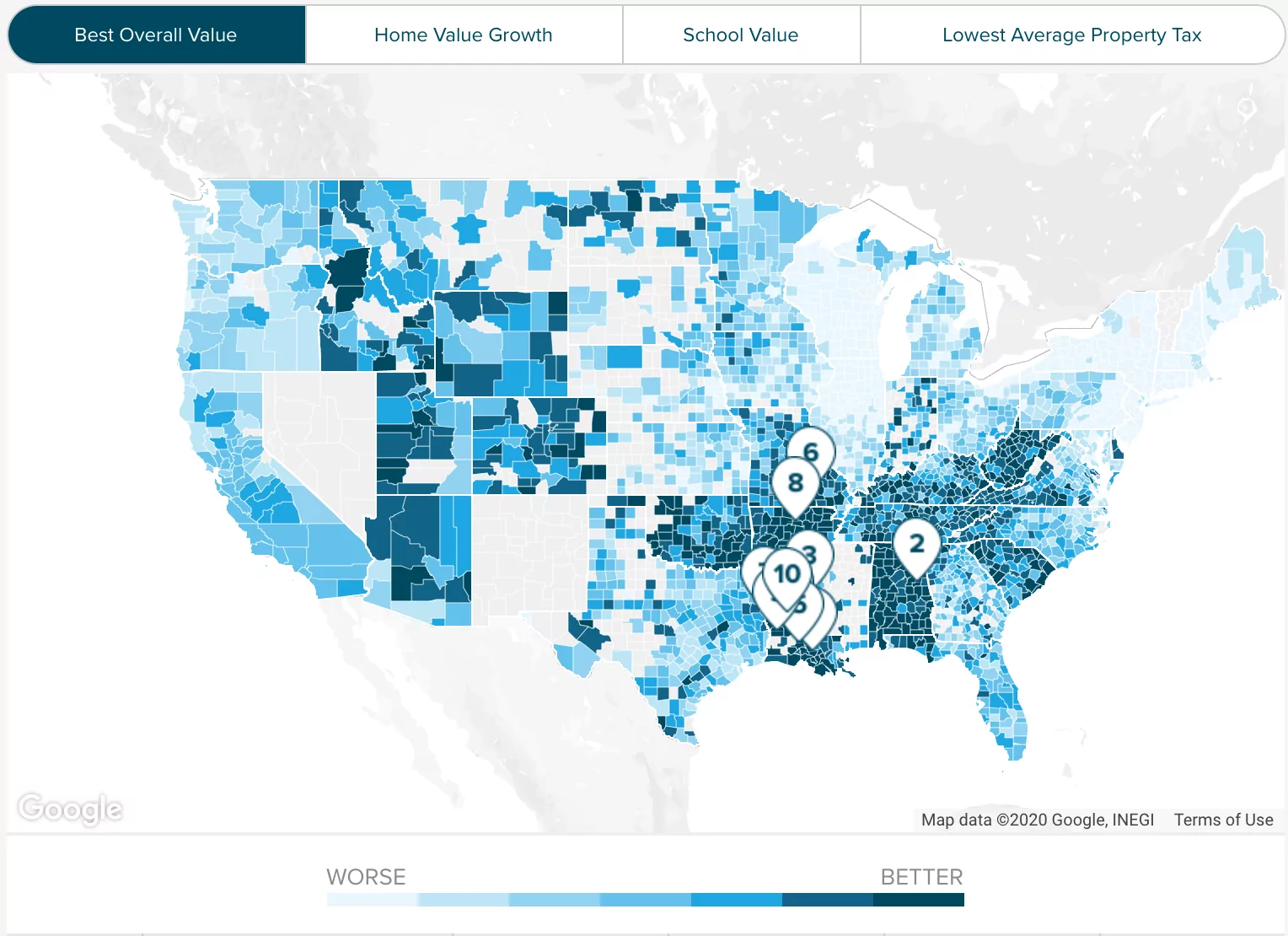

School current tax bill for 07012021 to 06302022. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in. Looking for more property tax statistics in your area.

Instantly view essential data points on Nassau County as well as NY effective tax rates median real estate taxes paid home values income levels and even homeownership rates. The New York state sales tax rate is currently 4. These higher taxes reflect rising property values.

When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. Remember you can only file once per year.

20222023 Tentative Assessment Rolls. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Your individual STAR credit or STAR exemption savings cannot exceed the amount of the school taxes you pay.

As part of a 35 billion county budget for next year Curran has proposed a 70 million property. Nassau County Property Appraiser. One-time payments to.

The Nassau County sales tax rate is 425. If you are able please utilize our online application to file for homestead exemption. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value. In Nassau County you can expect to pay an average of 224 of your homes assessed fair market value. Discover the Registered Owner Estimated Land Value Mortgage Information.

The tax reassessment affects 400000 residential and commercial properties in Nassau County. If you have any questions his office can be reached at 904 491-7300. This is the total of state and county sales tax rates.

20212022 Final Assessment Rolls. More than 39000 homeowners will see increases of more than 3000 while 11000 will see increases of 5000 or more. The Nassau County sales tax rate is 425.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. If you have any questions please contact us at 904 491. Wont my property taxes go down if my assessment goes down.

I would encourage you to participate in this process. 86130 License Road Suite 3. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

They will use these values to help determine their tax rate for the property owners of Nassau County later this summer. Ad Property Taxes Info. In Nassau you file with the Assessment Review Commission and the deadline is March 1 2021.

The Notice of Proposed Property Taxes TRIM Notice informs the owner of their proposed property values exemptions and millage rates for their upcoming tax bill. How much are taxes in Nassau County. Suffolk County is a fraction more expensive clocking in at an average of 23 of the assessed fair market value.

New York Property Tax Calculator Smartasset

Rising Home Prices Lead To Higher Loan Limits For 2022 In 2022 House Prices Buying Property Jumbo Loans

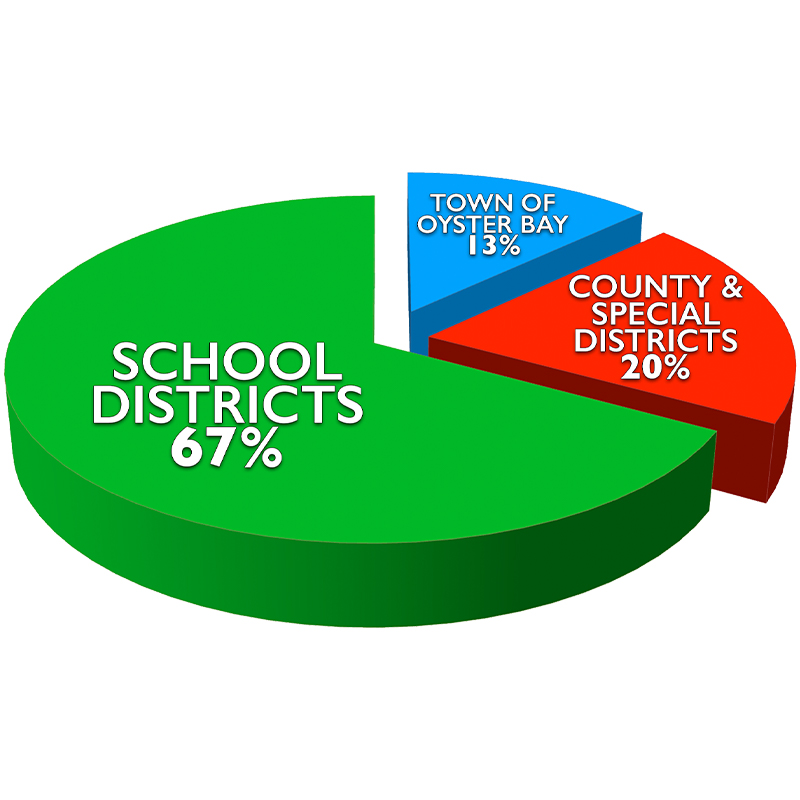

Receiver Of Taxes Town Of Oyster Bay

Update To New York City Property Tax Rates Property Taxes United States

Attom Single Family Home Property Taxes Increased To 328 Billion In 2021 Mortgageorb

Cogneesol S 5 Step Tax Preparation Process Tax Preparation Tax Preparation Services Tax Consulting

Tax Information Hempstead Town Ny

Tax Exemptions Town Of Oyster Bay

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

New York Property Tax Calculator 2020 Empire Center For Public Policy

The Essential Guide To San Francisco S Steepest Streets San Francisco Streets San Francisco Francisco

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Nassau County Ny Property Tax Search And Records Propertyshark

Doubling Tax Rate Some Homeowners File Disputes Over Nearly 200 Real Property Tax Hike Eye Witness News

Harris County Tx Property Tax Calculator Smartasset

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nassau County Ny Property Tax Search And Records Propertyshark